I hope you find my writing and business tips and observations useful. My business and blog are dedicated to helping businesses communicate clearly and reach their potential.

Read, subscribe to my newsletter, enjoy!Tash

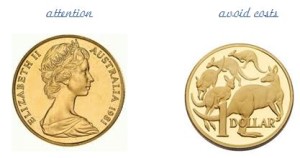

One coin, two sides; One budget, two perspectives

There are always two sides to a coin, two side to a story and two perspectives to view things by.

On Tuesday, the Federal Budget was announced.

I’ve read quite a few summaries of the Budget so I can write updates for clients. Some are better than others, of course.

Perspectives of the Federal Budget

However, my point relates to how small business is impacted by this Budget. Noting that small business got very little direct mention by the Government in this budget.

A number of business groups have released their view that Government ignored this significant sector of our economy. As advocates of this diverse group, they are annoyed because small business don’t appear to have been included.

Yet another business group or two has put out the view that small business was lucky to have avoided the attention big business got in the Budget. I for one am glad we don’t have to report PAYG each month, for instance.

Both views are based on the same fact (little mention of small business) but are looking at it in different ways. I found that very interesting.

Why do small businesses start?

I spent last night talking with my daughter about her subject choices for school. It’s not an easy decision and there are more interesting subjects than there are spots in her timetable so each subject has to be considered for its merits.

One subject we discussed was Small Business Management (note the capitals as a subject name). The course description included ‘find out why small businesses start, what sort of businesses there are and small business marketing’.

I thought that to be an interesting choice of topics – there are so many reasons people start small businesses! Do they study a regimented ideal or will they really look at the breadth of small business types, structures and reasons for existence?

My daughter was really pleased I offered to talk to that class if the teachers wanted me to, which was nice but slightly off my topic 🙂

Why did I start my small business?

I can’t answer a simple question of why small businesses start – I think there are too many reasons to cover simply. But I can tell my story.

I can’t answer a simple question of why small businesses start – I think there are too many reasons to cover simply. But I can tell my story.

I have always been able to write (ok, since I passed Prep anyway!) but it took some time for me to realise that I do it well compared to many people and with relative ease. My love of reading and writing has certainly been a big part of my life – English was always a favourite school subject.

The idea of working for myself appealed, but I didn’t think I had anything worth selling nor the capital to start a business. So I had a variety of jobs until I was home with young children.

Thinking about what I wanted to do, work wise, so I could build skills in between parenting tasks, I liked the idea of being flexible so I was available for my children and just reporting to myself.

A friend asked for some help with her resume and covering letter – and was enthusiastic about the results and commented on how good I was at writing and seeing to the point of what needed to be written.

I helped edit the cookbook our kinder created as a fundraising project.

Then the penny dropped and I fully realised that good writing is a valued commodity that I can provide, and that running my own writing business would offer me flexibility and control.

It was also a business I could start with little financial outlay so I dabbled, got some initial clients and then set up business properly.

Are starting reasons the ongoing reasons?

I find it intriguing whether or not the reasons someone starts a business are the same reasons that keep them going a year or five years later.

Word Constructions was started so I could be at home, working around my children, using my skills and being my own boss.

Now, nine and a half years later, it still gives me flexibility for my children, utilises my (more refined) skills and lets me be my boss (although clients have a certain amount of control, too, really!). I find that it also has developed a passion for clear communications – a passion to see more clear communications and to help other businesses communicate more effectively.

How about you – are your motivations the same as when you started a business? If not, how have they changed?

My passion to help others communicate clearly fuels this blog, my Twitter objectives and my monthly newsletter.

Outsourcing gives control, rather than takes it

Outsourcing means getting someone else to do a task (or tasks) for you so you can spend time doing other things; as a sole trader it is pretty much mandatory to outsource to succeed.

Sounds like a strong statement?

It is a strong statement but that doesn’t stop it from being true.

Small business people have a lot to do

There are many tasks that need to be done to keep any business running – accounts, invoicing, customer service, marketing of some sort and general admin are the minimum. Then there’s the specific work of that business plus managing a website and additional marketing.

And the list keeps growing. With the introduction of blogs then social media (and more and more platforms), businesses have more tasks to add to the daily to do list than ever before. Even if you aren’t doing much on social media, you should be aware of it so you are deciding to not use it (rather than just ignoring it) and monitoring it is a good idea, too.

When there’s only you, there is a big pressure to stay on top of everything and be in control. Let’s face it, there is no one else to pick up any slack, is there?

Handing over tasks

A conductor controls an orchestra without being the orchestra – outsourcing makes you the conductor of your business

Earlier this year, Jane Shelton blogged ‘You can maintain your sense of control by outsourcing many of the routine elements of your business.’ Outsourcing does not have to mean giving up control of your ‘baby’.

Think of tasks left undone or ideas not followed up on because there is no time.

Think of those tasks done in a rush rather than with care and attention because the to do list is so long.

Think of the last time you planned your week’s activities rather than swayed from one urgent activity to the next and hoped for a moment of breathing space.

Still think outsourcing takes away control?

Outsourcing simply means choosing which things to get someone else to do – either to save you from boredom, save you time or to gain expertise and skills you just don’t have.

For example, I outsource my filing (to my daughter!) which I find boring, my bookkeeping to gain back time and any design work as I don’t have those skills. So I can focus on writing for clients, advising clients and caring for my business.

Choose who you outsource to and you still control the outcomes. If you want, outsource most of a task and finish it off yourself if that feels better – but I bet you’ll soon give the entire task away!

What do you do?

List all the tasks you do for your business. Yes, all of them.

Long list?

Categorise them (the list Jane gives in the afore-mentioned blog post is a good system).

Now, sit back and imagine your business life if you had an extra two hours a week…

How would you spend another four hours a week in your business? How much would your profits grow by?

Want to keep that dream and feeling alive? Outsource something – just some little task so it doesn’t feel like you’re handing over your baby. Maybe get your account data entry done, ask for a blog post to be written or have your office cleaned by someone else.

Then you just have to keep on taking baby steps until you have outsourced enough to regain control of your business.

So the only question left is what will you outsource first?

Carbon pricing your business

The carbon tax should be protecting beautiful places like this (Ricketts Point in bayside Melbourne)

Have you thought about how the Carbon tax will impact your business and pricing structure yet? Will you update your web content to mention carbon pricing?

Now that the lower house has passed the carbon tax legislation, we know it’s likely to be in place next July and have some idea about what is involved. For instance, next financial year carbon will be taxed at $23 per tonne and we’ve been told to expect a 0.7% increase in living costs (although some or all of this may be covered with tax cuts and increased Government payments). The price would change the following year, and beyond.

Carbon tax for small business

Small businesses won’t have to directly pay a carbon price like the big 500 corporates, but that doesn’t mean we are unaffected. At the minimum we will face increased power costs and (as I understand it) small businesses are not getting anything in the compensation packages.

How will this impact on your business? Can you absorb the increases or will you need to update your prices?

Personally it will be increased power costs that will affect my business, along with (potentially) higher supplier costs. Only I have no idea what ‘$23 a tonne of carbon’ means for my electricity bill.

For a business delivering goods, buying materials for manufacture or providing mobile services, the impact could really add up.

Capping price increases

As individuals, it is good to know that the ACCC will be watching for price increases above 0.7% (where labelled due to carbon tax) so we aren’t ripped off. As business owners, it’s tough – will our cost increases be less than 0.7%? can the business afford to pay the owner(s) more to help with higher living costs? can I increase my prices and increase additional costs (e.g. delivery) by 0.7% each and be operating legally?

It sounds simple – use a lot of carbon, produce a lot of greenhouse emissions, and pay for it. Implementing it into real business practices is going to be harder.

So what are your thoughts about small business pricing next year? Any idea how your business will deal with it?

PS You can learn more about carbon pricing, it’s value and climate change through COs Australia’s You Tube channel.

Victorian small business info line

Consumer Affairs Victoria has opened a free phone line specifically for small business people.

As a small business in Victoria, you can now get

- free information about your rights for products and services that don’t meet your expectations (did you know small businesses have rights to repairs, refunds and replacements like other consumers?)

- free information about resolving disputes between businesses

- a better understanding of relevant laws

- somewhere to report scams aimed at small businesses

You can access the info line by calling 1300 098 631 or emailing small bu******@*************ov.au – or find out more on the CAV website.

If you’ve used this service, what was it like? Did it help you get thins sorted quicker than you could have done by yourself?

Government help for small business…

“Businesses in Australia – especially small businesses – are the engine of the Australian economy and deserve direct support during a global recession.”

I agree with the Treasurer that Australian business are a crucial part of our economy – and helping those businesses will therefore help the economy.

Yesterday, the Rudd Government announced a huge package to help prevent or reduce the recession for Australia. Part of the package is aimed at business, whilst the remainder is aimed at creating jobs and increasing spending.

The small business and general business tax break is described in the Treasurer’s media release and fact sheet. For most small businesses, it makes the purchase of a new computer or other eligible assets (excluding cars and trading stock) more affordable.

Great news if you need a new computer – or you sell computers!

There are of course conditions to qualify for these deductions, such as having a turnover under $2 million to qualify as a small business.

The 30% tax deduction only applies for assets greater than $1,000 which may exclude many micro businesses. For example, an additional $300 deduction applies if you buy a $1,000 computer before the end of June 2009 – how many micro businesses would be buying a $1,000 computer unless in that industry?

However, if you are considering buying a new sewing machine, desk, computer, printer, camera, or similar, maybe the tax deduction will make it feasible for you to buy a larger and more expensive model.

How valuable do you think this tax break will be for your business? Will it impact on your buying decisions in the next few months?

Recent Comments